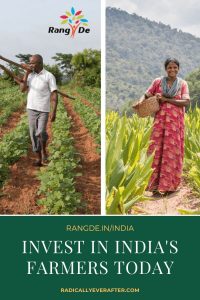

Invest in India’s Marginalized Farmers with Rang De

“If you ate today, thank a farmer” – you must have heard these words before. To make a difference in a farmer’s life within a few days, make an interest-free loan through Rang De today. Even small amounts make a huge difference, so social investments begin at INR 100. Loans to farmers begin at INR 2,000. Both are repaid within a year.

What is Rang De?

Founded by Smita Ramakrishna and Ramakrishna NK in 2008 as a social initiative, Rang De is an online peer-to-peer lending platform that connects social investors to rural entrepreneurs in need of credit. Based in Bangalore, it has been leveraging the power of the internet to connect people who want to make a sustainable difference to those who are denied or not offered credit.

For 12 years now, it has been serving the credit needs of thousands of under-served communities across India with low-interest loans. This year the focus at Rang De has shifted to small and marginal farmers because their needs have been the most urgent through the Covid-19 crisis which led to falling grain prices, reduced exports and reduced liquidity. Zero-interest loans are being given instead of low-interest loans because of the extent of the current crisis.

The Aim

In Smita Ramakrishna’s words, “Our mission is to make poverty history in India by addressing credit needs of under-served communities here. We strive to achieve this through a network of individuals and social investors spread across the country.”

“Our long-term vision is to be able to disburse Rs 100 crore annually,” says Ramakrishna. “This could go a long way in making poverty history in India.”

How is Rang De different from micro-financing organisations?

Rang De is a social investment organisation and not a micro-financing institution. A key feature that distinguishes it from several microfinance units in India is the focus on lowering interest rates to make loans affordable. With microfinancing in India, there has been some success but sadly there have also been hundreds of instances where borrowers ended their lives when they were unable to repay their loans. Rang De’s goal right now is to help small and marginal farmers tide over the current crisis with the help of interest-free loans – social investments made by socially aware citizens such as you and me.

The Focus on Farmers

INVEST IN A FARMER TODAY

Covid-19 has hit our small and marginal farmers harder than the already overwhelming pressures of lifelong poverty, general public apathy and monsoon delays. The lockdown in India began in March, landing like a sledgehammer on the harvest season of the rabi crops which began right then. Unlike other small businesses, a farm cannot be put on hold or returned to later to pick up right where one left off. The people we depend on for food production are the ones bearing a massive brunt of the pandemic. Recent years have seen several thousands of farmer suicides, something that ought to concern us enough to help farmers in whatever ways we can. In 2018, the number of suicides in the farming sector was reported to be 10,349 by the National Crime Records Bureau. This amounts to about 30 suicides per day. For more elaborate reports on farmer suicides in India, go here and here.

My experience with Rang De

I’ve been investing in Rang De since 2015 and I’ve been repaid in a matter of months every time I’ve invested and re-invested the repayments. Keeping track of loan disbursements and returns on their website is easy, and one can choose to withdraw or re-invest every time a loan is repaid.

Transparency is prioritized at Rang De, so every social investor can see where, when and which borrowers her money has reached. Regular updates, pictures and detailed information about the borrowers are shared on their online portal, and field trips have been organized every few months for the social investors to meet the borrowers in a particular region.

Overall, Rang De has a 93% repayment rate. In the event of a borrower’s death, their debt is written off and the social investor is informed right away.

The Impact of Rang De’s Initiative for Farmers so far

So far Rang De has 3,565 social investors and loans have been disbursed to 1023 farmers in Telangana, Orissa, Madhya Pradesh, Andhra Pradesh, Maharashtra and Karnataka. Rajasthan, West Bengal and Tamil Nadu are in the pipeline. So far, 81% of all farmers supported have been women.

The Challenges

Earning people’s trust has been one of Rang De’s big challenges. In the founders’ words: “We are overcoming this challenge by focusing on some of our non-negotiables – transparency and communication. We go out of our way to communicate to our social investors – be it good news or bad news, keeping the communication channel open is very important.”

A note to international lenders: Because Rang De is an NBFC (non-banking financial company) under RBI regulations, only people of Indian origin can invest in it. If you’re an Indian living abroad, an NRO bank account and an OCI certificate will be required.

I’m going to leave you with a few thoughts from one of my favorite authors who also happens to be a farmer – Wendell Berry

“To be interested in food but not in food production is clearly absurd. Urban conservationists may feel entitled to be unconcerned about food production because they are not farmers. But they can’t be let off so easily, for they are all farming by proxy.”

WHAT YOU CAN DO TO HELP

The urgent question is – Will we be part of the change and help a farmer today or ignore their plight and lament more farmer suicides tomorrow?

This is a race against time, as these loans will only be relevant and useful to farmers during the sowing phase of the Kharif season, before the monsoon arrives in full force around mid-July.

Every social investment makes a difference. Every action and inaction has consequences. I hope you will choose wisely and act today to make a difference to the people responsible for the food on our plates.

For more information on Rang De, visit their website https://rangde.in/india

If you have any questions, comments and suggestions, please feel free to leave a comment.

Liked this post? PIN IT !

Good

Wish I could invest but at present am not in India. Will post maybe others in India will.

Yes Jane please do share 🙂 Every little bit of money will go a long way. Thank you so much for writing in 🙂